Yesterday

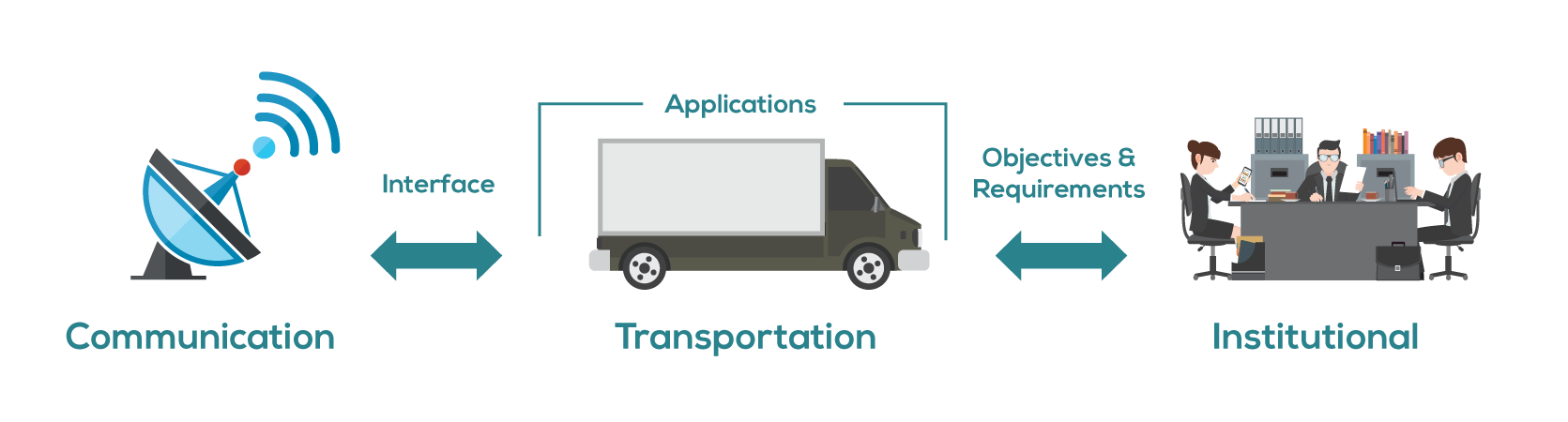

Telematics has developed from early day stand-alone system (e.g. vehicle location tracking) to a more interactive, intelligent and event-driven systems.

Telematics has developed from early day stand-alone system (e.g. vehicle location tracking) to a more interactive, intelligent and event-driven systems.

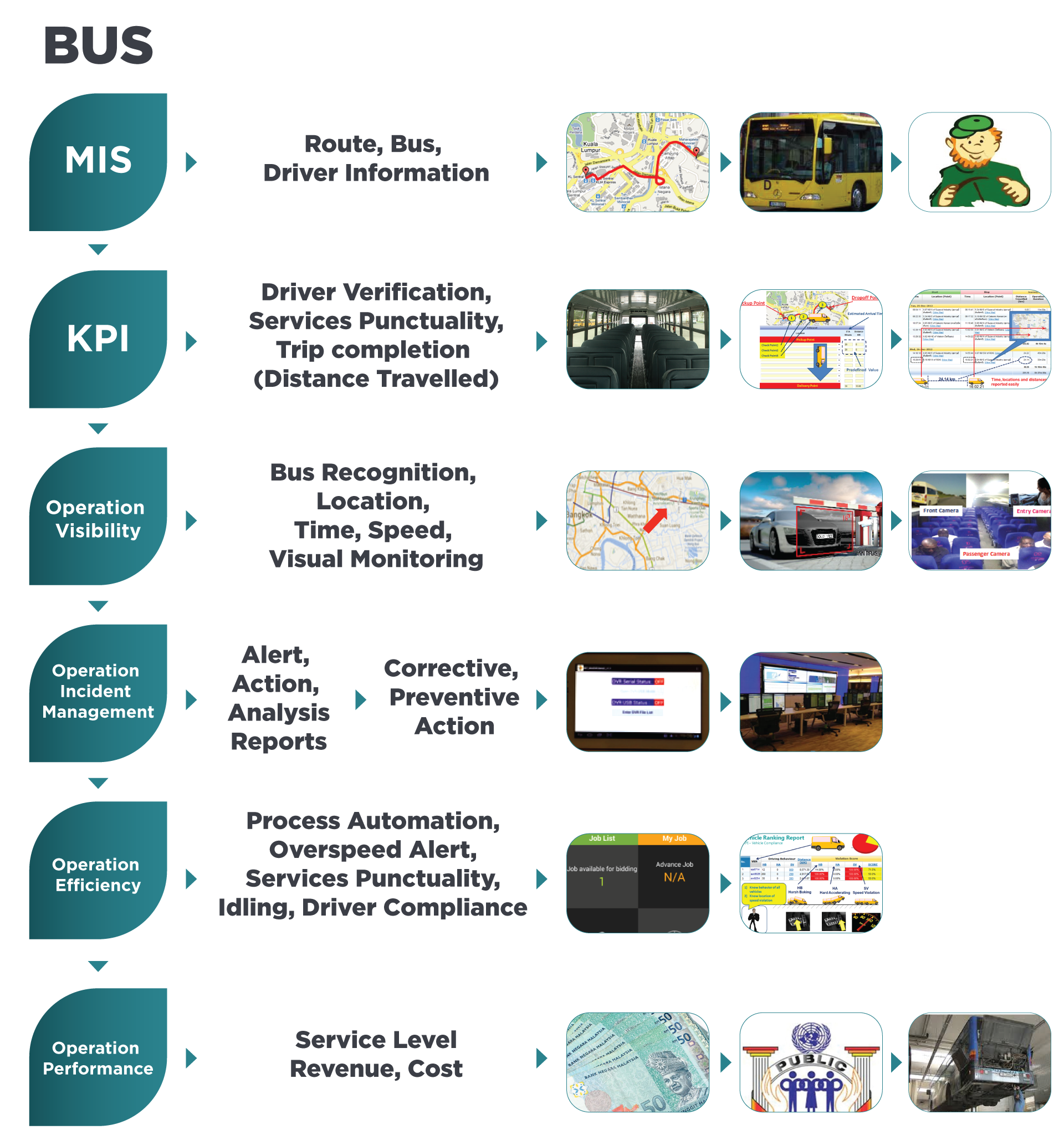

Telematics increasingly forming part of transport management systems that monitor, communicate, evaluate and respond to events dynamically.

Usage-Based Insurance (UBI) is a recent innovation by auto insurers that more closely aligns driving behaviors with premium rates for auto insurance. Introducing Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Pay-As-You-Go, and Distance-Based Insurance.

Mileage and driving behaviors are tracked using odometer readings or in-vehicle telecommunication devices (telematics) that are usually self-installed into a special vehicle port or already integrated in original equipment installed by car manufactures. The basic idea of telematics auto insurance is that a driver’s behavior is monitored directly while the person drives. These telematics devices measure a number of elements of interest to underwriters: miles driven; time of day; where the vehicle is driven (GPS); rapid acceleration; hard braking; hard cornering; and air bag deployment. The level of data collected generally reflects the telematics technology employed and the policyholders’ willingness to share personal data